Overcapacity is continuing to take its toll on PV module prices, according to the latest ‘Solarbuzz Quarterly’ report. Factory gate prices are claimed to be down 33% year-on-year and will fall a further 18% in the fourth quarter of 2011. Solarbuzz warns that module inventory levels could reached almost 22GW by the end of next year if production is not cut drastically. The backdrop for the supply and demand imbalance is installation levels that are proving to be weaker than expected.

“Anticipating that falling prices could stimulate demand by year-end, downstream companies across Europe face the unnerving decision of whether to build inventories at the end of Q3’11,” said Craig Stevens, president of Solarbuzz. “Any over-estimate of that demand ahead of an expected 15% German feed-in tariff reduction at the start of 2012 would likely result in further year-end inventory write-downs.”

According to the market research firm, European markets are projected to account for 58% of global demand in the third quarter of 2011, down from 78% in the same quarter of last year. However, market emphasis is now shifting, especially to the US and China. The report states that these two nations are seeing the fastest rates of growth among major markets in Q3.

Inventory overhang

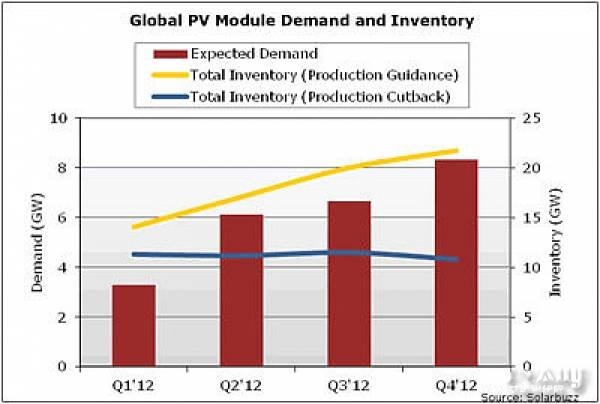

Solarbuzz noted that few - if any - Tier 1 module manufacturers have cut production so far this year. With little change yet seen from Tier 1 suppliers over their second-half shipment guidance, Solarbuzz is projecting that global shipments will exceed end-market demand by 4.4GW, while crystalline silicon factory-gate module prices are now projected to fall 18% in Q4’11 q-on-q.

With cell capacity expected to increase by 50% over 2011 levels, market conditions can only worsen. Indeed, Solarbuzz says that end-market demand is forecast to increase by less than half that amount next year, further adding to the woes.

Consequently, Solarbuzz foresees a period of financial losses, company closures and consolidation in the not-too-distant future.

Stevens added, “This is a strikingly similar equation to the supply/demand balance that existed 12 months ago and resulted in collapsing prices through the PV chain. In contrast, though, margins are already at a breaking point, thereby increasing the likelihood of more company consolidations and liquidations next year.”

Solarbuzz noted that for the module suppliers to maintain the same level of inventory days as projected for the end of 2011, forecasted production levels would need to be cut back by approximately 11GW. In the event that this is not achieved, the industry will see module inventory levels reach almost 22GW by the end of 2012.