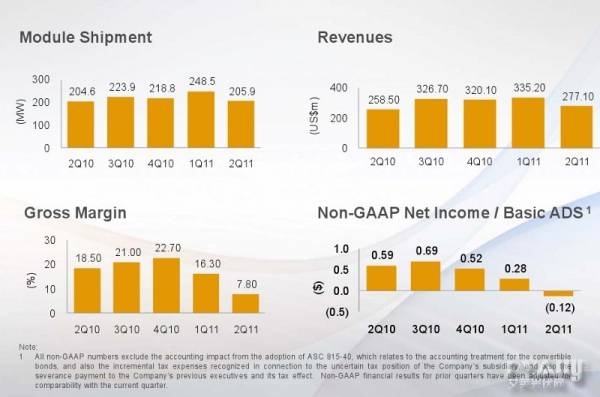

Hanwha SolarOne advised upon the release of its second quarter 2011 financial results that it had seen a decrease in its net revenues and PV module shipments on a quarter-over-quarter basis. Revenues for Q2 2011 were finalized at US$277.1 million, down 18.4% from US$335.2 million in Q1 2011. Although revenues were up 2.2% when compared to Q2 2010 results, Hanwha noted that the lower results quarter-over-quarter for fiscal 2011 were due to lower shipments and ASP.

PV module shipments for the quarter, including module-processing services, totaled at 205.9MW, compared to 248.5MW in Q1 2011 and 204.6 in Q2 2010. The 17.1% drop from Q1 2011 to Q2 2011 was attributed to a diminished demand early in the quarter compounded with the company’s decision to reduce its manufacturing utilization in response to falling selling prices.

The ASP, discounting module-processing services, sank to US$1.56/W from US$1.71 in Q1. According to the company, the drop in ASP was related to an industry supply and demand imbalance, coupled with FiT reductions in Germany and Italy. Additionally, Hanwha’s gross margin also took a hit, plunging to 7.8% in Q2, compared to 16.3% in Q1. The results for Q2 were related to a decline in ASP and the surge in the blended costs of goods sold (COGS) from lower manufacturing utilization. The blended COGS per watt, excluding module-processing services, was US$1.44, a 0.7% increase from US$1.43 in Q1.

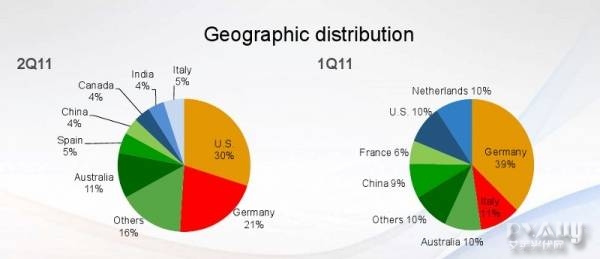

The US market once again dominated Hanwha’s shipments accounting for 30% of the total shipments made in Q2 2011 and representing a 10% increase over US shipments in Q1. Australia also delivered a strong Q2 demand, taking 11% of the company’s shipments during the quarter. Hanwha noted that Germany’s market demand slowed and dropped to 21% in Q2, from 39% in Q1, which the company maintains is due to customers postponing their purchases after the German government announced its lower FiT structure. Hanwha expects demand from Germany to pick back up in the second half of 2011.

Italy’s market demand also dipped from 11% in Q1 to 5% in Q2. The company advised that the Italian market results were related to the regulatory changes reducing FiT incentives in the European nation. China’s market also fell prey to falling demand, dropping to 4%, compared to 9% quarter-over-quarter. Hanwha did make special mention that it had shipped to two new markets during Q2, Canada and India. Each accounted for 4% of shipments for the quarter.

Ki-Joon Hong, chairman and CEO of Hanwha SolarOne, commented, "We were not insulated from the difficult operating environment during the second quarter. Regulatory changes in Italy, rapidly falling module prices, industry overcapacity and large channel inventories all negatively affected our second quarter results. We consciously reduced our manufacturing activities for a period of time to control expenses, manage working capital, and prevent the build-up of high cost inventory. We did not retreat from our aggressive posture towards the future. We moved forward with our capacity expansion plan, invested in management systems and personnel and made good progress in branding initiatives and research and development. We expect that demand will improve for the remainder of the year."

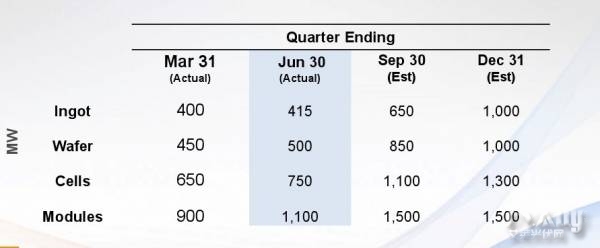

Hanwha advised that its ongoing capacity expansion should allow it to increase scale with a capacity ramp up in the second half of 2011 and lead to a possible shipment growth. For Q3 2011, the company provided ramp up guidance of 650MW for ingots, 850MW for wafers, 1,100MW for cells and 1,500MW for modules. The company additionally noted that the infrastructure in Nantong had been finalized and should allow for a potential 2012 capacity expansion.

In giving its outlook for the full year 2011, Hanwha anticipates module shipments to reach 1GW and fall at the low-end of its previously announced range of 1GW to 1.2GW. Module processing services are expected to account for 20% to 25% of its business with capital expenditures finalized around US$400 million.